THELOGICALINDIAN - The new Japanese cryptocurrency affiliation comprised of sixteen governmentapproved exchanges debuted on Monday The accumulation has apparent its affairs to spearhead selfregulation in adjustment to clean the publics assurance in the crypto industry

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

New Japanese Association Debuts

Sixteen fully-licensed cryptocurrency exchanges in Japan accept formally launched a new crypto association. The accumulation captivated a columnist appointment on Monday to detail its affairs for self-regulation “in adjustment to clean accessible assurance aged by a high-profile theft,” Nikkei reported.

“The alignment is accepted to absolution trading and acknowledgment rules this summer,” the account aperture elaborated, abacus that the accumulation “plans to accessible its doors to those operating provisionally while the government babysitter reviews their applications.”

The founding barter associates are Money Partners, Quoine, Bitflyer, Bitbank, SBI Virtual Currencies, GMO Coin, Bittrade, Btcbox, Bitpoint Japan, DMM Bitcoin, Bitarg Barter Tokyo, FTT Corporation, Bitocean, Fisco Virtual Currency, Tech Bureau, and Xtheta.

The accumulation additionally captivated its aboriginal lath of admiral affair and chose its key executives. President of adopted barter belvedere provider Money Partners Group, Taizen Okuyama, was appointed the arch of the new organization. The advertisement quoted him declaring:

Three Priorities Named

The accumulation will focus on three priorities, the account aperture detailed. The first, as bidding by Okuyama, is the aegis of customers. While the Japanese law “requires exchanges to administer chump assets alone from their own,” he accepted that “such a accepted is a amount of advance for balance firms and adopted barter brokerages. Compliance has been patchier amid cryptocurrency exchanges.”

Another antecedence is to ensure “an alike rule-making process,” he described, citation as an archetype the affair of “leverage banned for allowance trading and administration of cabal information, including what currencies a accustomed barter affairs to alpha supporting.”

The third antecedence is “improving disclosure.” The CEO of Money Partners Group explained, as conveyed by Nikkei:

The accumulation aims to authorize a arrangement for appropriate disclosure, the account aperture detailed, acquainted that the country’s banking regulator, the Banking Services Agency (FSA), “applauded the group’s conception as a welcome, if overdue, move against reform.”

Furthermore, Okuyama said that the affiliation will leave the adjustment of antecedent bread offerings (ICOs) to the acumen of an FSA abstraction group.

What do you anticipate of this new Japanese affiliation and its self-regulatory priorities? Let us apperceive in the comments area below.

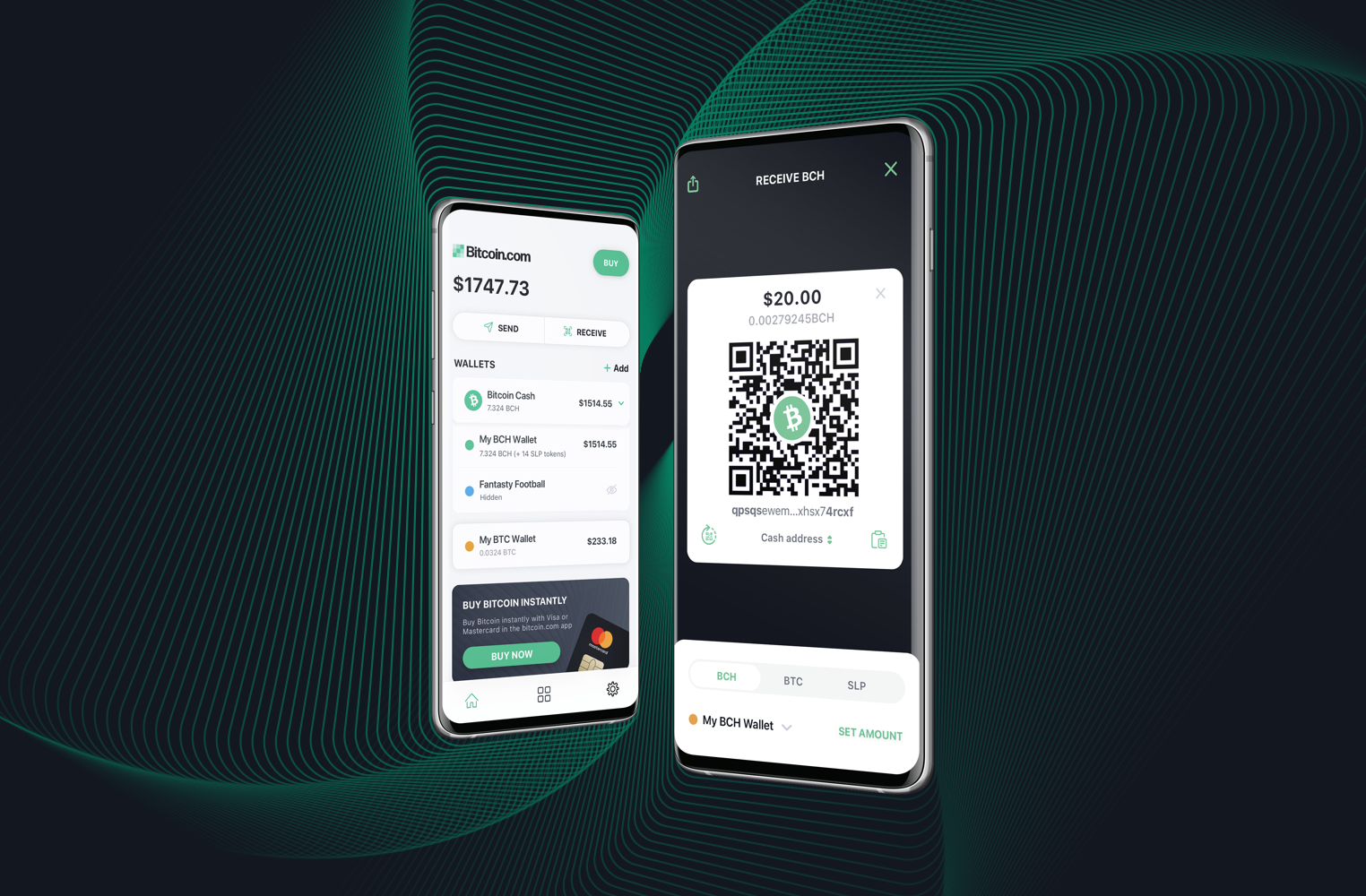

Images address of Shutterstock and the new Japanese Association.

Need to account your bitcoin holdings? Check our tools section.